Earning a little extra cash without even leaving your house sounds pretty sweet, right? Whether you’re looking to pay off some bills, save for something big, or just have some extra spending money, there are tons of ways to make it happen from home. The internet has opened so many doors—with social media, freelance gigs, tutoring, and even selling crafts—but it also comes with responsibilities, like managing taxes. Don’t worry, though; this guide will break it all down for you.

Small Ways to Earn Extra Income

1. Social Media Content Creation

Platforms like TikTok, YouTube, Instagram, and Twitch have become gold mines for people looking to turn their hobbies into side gigs. If you enjoy making videos, streaming gameplay, or sharing tips on something you’re passionate about, social media could be your ticket to an income boost.

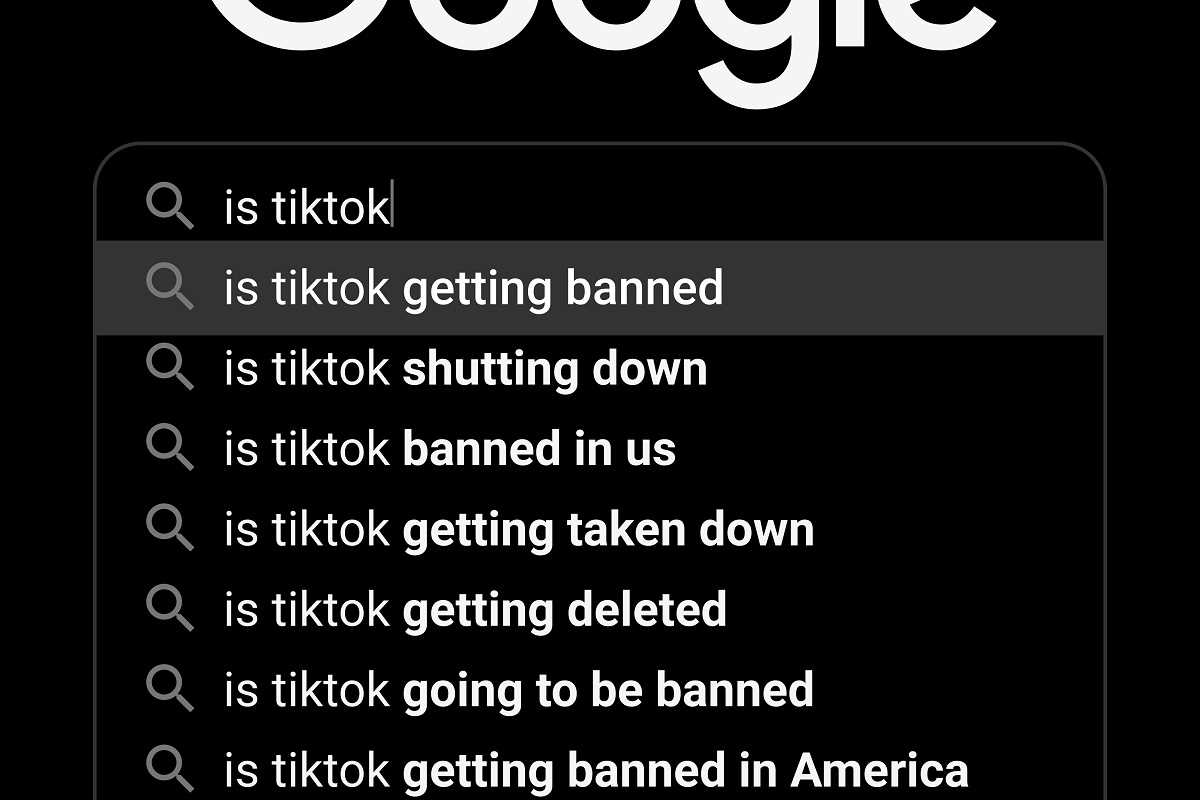

- TikTok: Aside from the potential ban, if you’re good at hopping on trends or creating unique content, TikTok offers opportunities to earn through brand partnerships, sponsored posts, or even going viral and getting discovered by companies.

- YouTube: Long-form content still thrives here, and YouTube pays creators through ad revenue. With a solid subscriber base, even a small channel can bring in extra money each month.

- Twitch: Gamers or people who love streaming live content can sign up to Twitch’s affiliate program to earn money through subscriptions, ads, and user “bits” (a virtual tipping system).

Pro Tip: To stand out on social media, be yourself and focus on what you love to do. Whether it’s baking tutorials, funny skits, or gaming walkthroughs, your passion will shine through and attract an audience.

2. Freelancing

Freelancing is one of the most flexible ways to earn money. You can work on your own terms, choosing projects that match your skills. Some popular freelance opportunities include:

- Graphic Design: If you love creating logos, illustrations, or posters, platforms like Fiverr and Upwork are great places to start.

- Writing: Blog writing, copywriting, or even creating captions for social media can pay well if you have a way with words.

- Virtual Assistance: Helping businesses or individuals with tasks like scheduling, responding to emails, or managing social media accounts can be an easy entry point to freelancing.

The great thing about freelancing is that you can tackle projects that match your schedule. Just be sure to set fair rates for your time and skills.

3. Selling Handmade Goods or Digital Products

If you’re crafty or creative, selling handmade items can turn your hobby into a side hustle. Sites like Etsy or Shopify allow you to sell your creations—like jewelry, candles, or custom artwork—to a global audience.

Not into making physical items? No problem! Selling digital products like printable planners, eBooks, or stock photos also works and doesn’t require you to ship anything. Once you create the product, it’s all passive income from there.

4. Online Tutoring and Teaching

If you’re great at explaining math formulas or helping someone write a killer essay, you can offer online tutoring services. Websites like Wyzant, Tutor.com, or even signing up to teach English learners on VIPKid can make you some extra cash. These platforms are especially helpful if you’re looking to share what you already know.

Gaming-related teaching is a growing trend, too! If you’re a Fortnite or Valorant expert, you could coach newbie players on gaming platforms or even through social media.

5. Completing Online Gigs and Surveys

If you’re looking for something super flexible, try simple online gigs. Sites like Swagbucks or Amazon Mechanical Turk offer quick tasks like data entry, surveys, or product testing. While these might not make you rich, they can bring in some easy pocket money.

6. Renting Out Items or Space

Have an extra room at home or a barely-used piece of gear sitting around? You can earn passive income by renting out what you own. Platforms like Airbnb make it easy to rent your space, or you could rent out items like bikes, tools, or photography equipment using sites like Fat Llama.

Tips for Managing Taxes

Earning extra income is exciting, but don’t forget that the money you make is still taxable. Even if it’s just a small side hustle, you’re responsible for letting tax authorities know what you’ve earned. Here are some tips to manage taxes like a pro.

1. Keep Records from Day One

Tracking your income and expenses is crucial. Whether you’re getting paid through PayPal, cash, or bank transfer, keep a record of every dollar that comes in. Similarly, track your expenses. Many costs, like buying equipment, running ads, or paying for internet service, could be considered business expenses and might reduce the amount of tax you owe.

Apps like QuickBooks or even a simple spreadsheet can help you stay organized. The key is being consistent—don’t wait until tax season to figure everything out.

2. Understand Deductions

When you earn money from home, you can deduct certain costs that are necessary for your work. These “deductions” lower the amount of income you’ll be taxed on. Examples include:

- A dedicated workspace or home office (even a small portion of your rent/utilities can count if you work from that space regularly).

- Any tools, apps, or supplies you need to perform your side hustle (like a microphone for recording videos).

- Costs related to advertising or promoting your services online.

3. Save for Tax Bills

When you earn money as a freelancer or through platforms like TikTok, taxes usually aren’t taken out, like they are with a regular job. Make sure you set aside a portion of each payment for taxes so you’re not caught off guard. A good rule of thumb is to save around 20-30% of your income.

Opening a separate savings account for taxes can help you avoid spending the money you’ll need later.

4. Know When to Seek Professional Help

If your side hustle grows into a major income stream, it might be time to speak with a tax professional. They can help you:

- Understand which forms you’ll need to file (like a 1099 form for independent contractors in the U.S.).

- Pick the right deductions to maximize your savings.

- Plan for paying estimated taxes if you’re making consistent income throughout the year.

While professional help costs money, it can save you from making costly mistakes or missing out on deductions.

5. Stay on Top of Tax Deadlines

Mark important tax deadlines on your calendar, so you’re not rushing to file at the last minute. If you miss a deadline, you could face penalties or interest charges. Depending on your earnings, you may also need to pay quarterly taxes, so plan accordingly.

6. Know the Rules for Platforms

If you’re earning through TikTok, YouTube, Twitch, or any other platform, take the time to check their tax guidelines. These platforms often send out tax forms if you earn above a certain amount, but it’s still your responsibility to report any income, even if it’s below the threshold.

Earning extra income from home is easier than ever thanks to social media, freelancing sites, and online marketplaces. Whether you’re building a following on TikTok, selling crafts on Etsy, or tutoring students online, there are endless ways to boost your bank account while staying in your pajamas. Just remember that every dollar earned comes with tax responsibilities, so stay organized, track your earnings, and consider speaking with a pro if you need help.

The hustle can be fun, creative, and rewarding, but balancing it with smart financial habits is the key to long-term success.